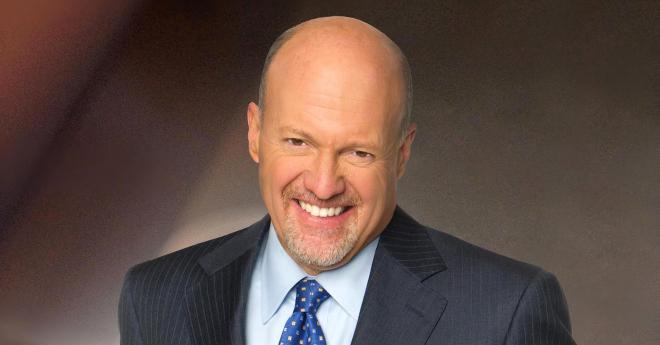

Uncovering Jim Cramer’s Wealth Secrets: Revealing His Net Worth and Investment Strategies

Jim Cramer is a successful financial market guru, stockbroker, author, and television host with an incredible reputation in the investment industry. He is famous for his loud and engaging personality as the host of CNBC’s “Mad Money,” a widely popular investment show. Cramer’s show is a hub of information about investment, personal finance, and market trends. In this blog post, we will uncover Jim Cramer’s wealth secrets, including his net worth and investment strategies, revealing what makes the Wall Street icon remarkable and widely successful in the world of finance.

Who is Jim Cramer?

Jim Cramer was born in Philadelphia in 1955 and grew up in Wyndmoor, Pennsylvania. He graduated from Harvard College with a degree in government in 1977. After college, Cramer worked in various entry-level jobs in the journalism industry, including a reporter job for the Tallahassee Democrat and an editor job for the Los Angeles Herald Examiner. However, he discovered his passion for finance in the late 1970s, leading him to attend Harvard Law School. After graduation, Cramer worked as a lawyer for two years before embarking on a successful career in finance that continues to this day.

What is Jim Cramer’s Net Worth?

Jim Cramer has a net worth of $150 million, according to Celebrity Net Worth. Cramer’s vast wealth comes from his various endeavors as an investment expert, host, and author. Some of his books include “Real Money,” “Confessions of a Street Addict,” and “Jim Cramer’s Stay Mad for Life.” Besides, he also founded TheStreet.com, a financial news website that IPO-ed in 1999 and has been providing investors with valuable insights to this day.

What Are Jim Cramer’s Investment Strategies?

Jim Cramer believes in investing in companies that he considers fundamentally strong, have a competitive advantage in their markets, and can provide long-term growth potential. Cramer emphasizes the importance of thorough research before investing and advises investors to do their homework, so they understand the ins and outs of the investment game. He also advocates diversification of the portfolio to reduce risk and advises against putting all the eggs in one basket.

Cramer’s Advice on Healthcare Stocks

Jim Cramer believes investing in health care stocks is essential because health care is one of the fastest-growing sectors of the economy and will continue to grow as the population ages. Cramer advises investors to invest in healthcare stocks, such as Johnson & Johnson, as these stocks are likely to have a long-term growth potential.

Cramer’s Advice on Technology Stocks

Jim Cramer is bullish on technology stocks, asserting that the tech industry will continue to grow and produce incredible innovations in the years to come. Cramer advises investors to invest in tech stocks such as Apple, Microsoft, and Amazon.

Cramer’s Advice on Energy Stocks

Jim Cramer is bearish on energy stocks, arguing that the energy industry is changing too fast to rely on energy stocks over the long term. Instead, Cramer advises investors to invest in companies with a strong focus on renewable energy and clean energy technology.

Cramer’s Advice on Real Estate Stocks

Jim Cramer believes that real estate stocks offer great potential for investment because they are highly cyclical and can generate substantial returns in a market upswing. Cramer advises investors to invest in real estate stocks such as Brookfield Asset Management and Invitation Homes.

FAQs

Q1. What is Jim Cramer’s advice on bond investments?

A1. Jim Cramer advises investors to invest in bonds, particularly those with a high yield and a short maturity date.

Q2. What are Jim Cramer’s views on gold?

A2. Jim Cramer is bearish on gold, arguing that investors should focus on investing in stocks rather than gold.

Q3. What are Jim Cramer’s preferred investment styles?

A3. Jim Cramer is a long-term investor who believes in buying fundamentally strong companies with a competitive advantage in their markets.

Q4. What do you say about Jim Cramer’s views on diversification of the portfolio?

A4. Jim Cramer advises against putting all the eggs in one basket and encourages investors to diversify their portfolios to reduce investment risks.

Q5. What are some of the strategies recommended by Jim Cramer for investing in the stock market?

A5. Jim Cramer recommends investors to invest in fundamentally strong companies, conduct thorough research before investing, and diversify their portfolios.

Q6. What is Jim Cramer’s opinion on investing in emerging markets?

A6. Jim Cramer believes that investing in emerging markets is an excellent long-term investment strategy because these markets offer tremendous growth potential in the future.

Q7. What is Jim Cramer’s advice to new investors?

A7. Jim Cramer’s advice to new investors is to do their homework, understand the ins and outs of the investment game, and start investing as early as possible.

Conclusion

In conclusion, Jim Cramer is a highly successful and reputable figure in the world of finance. His vast wealth, investment strategies, and advice to investors are a reflection of his years of experience and knowledge in the investment industry. If you want to succeed in the stock market, you can take a cue from Jim Cramer’s investment strategies and advice.